Shani Finserve Loan Magic Fast, Easy, Zero Drama in just 24-48 Hours

Need quick cash but don’t know how? At Shani Finserve, there are no queues, no confusion just smart and fast loans. We turn your dreams into reality.

- → Click a button, not a hundred forms.

- → Our team talks human, not bank-ish.

- → Blink, and your docs are already verified.

- → Before you panic your loan is approved.

- 1. Documents verifications is super easy here- we need basics

- 2. You can get loans super-fast here- without the drama.

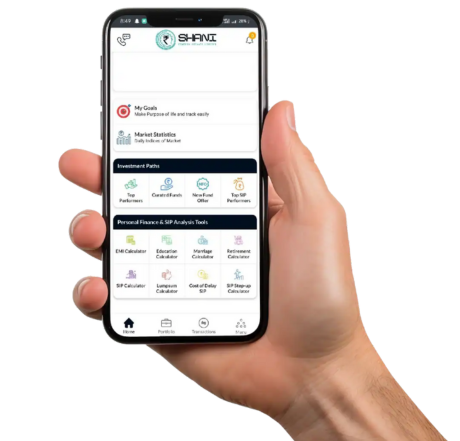

Calculate Your Loan

& Get Detailed Insights

Plan your finances better with our advanced loan calculator that includes inflation adjustments and detailed payment schedules.

Finance Magic - Loans that Work for You

Welcome to Shani Finserve - where every money matter is handled easily, wisely, and without any stress. Whether you want to buy a car, chase a dream, or own your dream home, we can make it happen.

Here, we believe that money matters should not be scary, but simple and hassle-free. And if you're thinking about the future, we have you covered with our mutual fund and insurance solutions. So go ahead and dream big. We have your back.

Whatever You Need, We’ve Got a Loan

From professional growth to fulfilling your dreams, you need finance and for your financial needs- the name is Shani Finserve. With our wide range of loans, fast approvals, flexible terms, and expert support- we are here to make borrowing easier, smarter, and perfectly suited to your needs.

Customer Feedback

Best financial service provider in Dibrugarh. They also provide hassle-free and fast processing of all the services. Overall a great experience with Shani Finserve.

Shani Finserve is a blooming money market today. Great place to find all your financial needs under one roof.

Best services for business loans, property loans & personal loans. They provide instant loan approval online in Assam.

Amazing service provided by the company—really smart and standard service. They are so systematic in all documentation work.

Really liked the way the team helps with loans. Must say, they are very responsive.

Our customer base

reaches India