An Initial Public Offering (IPO) is a significant event for any company that wants to be listed on the National Stock Exchange, as it marks the first time the company’s shares are made available to the public. For investors, like you, participating in an IPO can be an exciting opportunity to invest in a company at its early stages of public trading. In India, the process of applying for an IPO has become increasingly accessible and straightforward, thanks to advancements in technology and online platforms. This article will guide you through the process of applying for an IPO in India, with detailed explanations and examples.

Table of Contents

What is an IPO?

An Initial Public Offering (IPO) is the process by which a privately held company offers its shares to the public for the very first time. By doing so, the company gets listed on a stock exchange, enabling the public to buy and sell its shares. Companies typically go public to raise capital for expansion, pay off debt, or fund new projects.

Investors can apply for an IPO during the subscription period, which is a few days when the IPO is open for bidding. The shares are allocated based on the demand and the subscription levels.

Steps to Apply for an IPO in India

Applying for an IPO in India involves several steps, from understanding the basics of the IPO to the final allocation of shares. Below is a detailed guide on how to apply for an IPO in India.

Step 1: Understanding the IPO

Before applying for an IPO, it’s essential to understand the basics of the offering. This includes:

- Company Background: Research the company, its business model, financial performance, and future prospects.

- IPO Details: Review the IPO prospectus, which includes the issue price, lot size, subscription dates, and the purpose of the IPO.

- Market Sentiment: Analyze market trends and expert opinions to gauge the potential success of the IPO.

Example:

Suppose XYZ Pvt. Ltd., a technology company, is planning to go public. As a potential investor, you should research the company’s financials, industry position, growth prospects, and how the funds raised will be utilized.

Step 2: Open a Demat and Trading Account

To apply for an IPO in India, you need a Demat account and a trading account. A Demat account holds your shares in electronic form, while a trading account allows you to buy and sell shares in the stock market.

- Choosing a Broker: Select a stockbroker or a bank that offers Demat and trading accounts. Many banks and financial institutions provide these services.

- Account Opening: Fill out the required forms, submit necessary documents (like PAN card, Aadhaar, and bank details), and complete the KYC (Know Your Customer) process.

Example:

Mr. Sharma wants to apply for the IPO of XYZ Pvt. Ltd. He opens a Demat and trading account with ABC Securities, a well-known stockbroker in India. He completes the KYC process and links his bank account to his trading account.

Step 3: Understand the Application Process

There are two main methods to apply for an IPO in India:

- ASBA (Application Supported by Blocked Amount):

- ASBA is a facility provided by SEBI that allows the bank to block the IPO application amount in your account. The money is debited only if the shares are allotted.

- You can apply for an IPO through the ASBA facility using net banking or by submitting a physical form at your bank branch.

- UPI (Unified Payments Interface):

- UPI is another popular method for retail investors to apply for an IPO. You can apply through your broker’s trading platform or mobile app using your UPI ID.

- The application amount is blocked in your bank account, and you receive a UPI mandate request for approval.

Example:

Mr. Sharma decides to apply for the XYZ Pvt. Ltd. IPO using the ASBA method through his bank’s net banking platform. He logs into his account, selects the IPO option, and fills out the necessary details.

Step 4: Fill Out the IPO Application Form

When applying for an IPO, you need to fill out the application form with the following details:

- Bid Price: The price at which you want to buy the shares. You can bid at the cut-off price (the final price decided by the company) or enter a price within the price band.

- Lot Size: The minimum number of shares you can apply for. Lot sizes are predetermined by the company.

- Investment Amount: The total amount you want to invest in the IPO.

Example:

The price band for the XYZ Pvt. Ltd. IPO is ₹100-₹120 per share, with a lot size of 100 shares. Mr. Sharma decides to bid at the cut-off price and applies for one lot (100 shares). His total investment amount is ₹12,000.

Step 5: Submit the Application

Once you have filled out the application form, review all the details carefully. After ensuring that everything is correct, submit the application through your chosen method (ASBA or UPI).

- ASBA Submission: If applying through ASBA, submit the application online via net banking or physically at the bank branch.

- UPI Submission: If using UPI, submit the application through the broker’s platform and approve the UPI mandate request.

Example:

Mr. Sharma submits his application for the XYZ Pvt. Ltd. IPO through the ASBA method using his bank’s net banking service. He checks all the details before confirming the submission.

Step 6: Wait for Allotment

After the IPO subscription period ends, the company and its underwriters determine the final issue price based on the bids received. The allotment of shares is done based on the demand and subscription levels.

- Allotment Status: You can check the allotment status online using your PAN or application number on the registrar’s website.

- Refund or Debit: If shares are allotted, the application amount is debited from your bank account. If not allotted, the blocked amount is released.

Example:

After the XYZ Pvt. Ltd. IPO closes, Mr. Sharma checks the allotment status online and finds that he has been allotted 100 shares. The blocked amount of ₹12,000 is debited from his bank account.

Step 7: Listing and Trading

Once the shares are allotted, they are credited to your Demat account. The company’s shares are then listed on the stock exchange, and you can start trading them.

- Listing Day: The shares are listed on the stock exchange on the specified date, and trading begins.

- Trading: You can choose to hold the shares for long-term investment or sell them on the listing day or anytime after.

Example:

XYZ Pvt. Ltd. lists its shares on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). Mr. Sharma sees that the share price has appreciated on the listing day and decides to sell his shares for a profit.

Hey learner wait: If you need any financial assistance/consultancy you can reach us through our Contact Us page. Shani Finserve is the only fastest-growing financial services company in the North-Eastern region of India. We provide the best loan services with low interest rates and an easy application process because we value your money and admire your growth. Feel free to contact us we are happy to serve you with the best of our facilities.

Key Considerations When Applying for an IPO

1. Research and Due Diligence

- Before applying for an IPO, thoroughly research the company’s financials, business model, and market potential. Read the IPO prospectus carefully.

2. Risk Factors

- Understand the risks involved in IPO investing. IPOs can be volatile, and there is no guarantee of listing gains.

3. Investment Horizon

- Determine your investment horizon. Are you looking for short-term gains or long-term investment? This will influence your decision to hold or sell the shares post-listing.

4. Market Sentiment

- Market conditions can impact the performance of an IPO. Consider the overall market sentiment and economic environment before applying.

5. Multiple Applications

- Avoid submitting multiple applications using the same PAN. SEBI regulations do not allow multiple applications by a single investor, and doing so may lead to rejection.

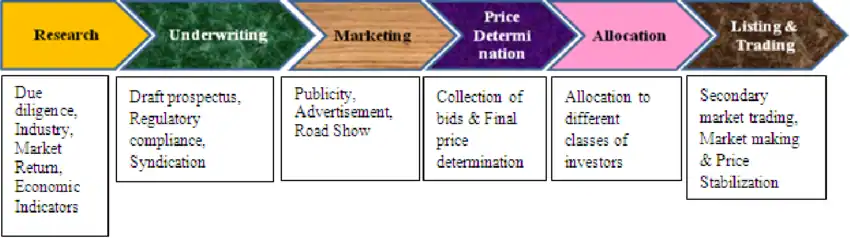

Steps Involved In The Process of IPO

Conclusion

Applying for an IPO in India is a relatively straightforward process, especially with the availability of online platforms and simplified procedures like ASBA and UPI. By understanding the steps involved and conducting thorough research, investors can make informed decisions and potentially benefit from investing in a company at its early stages of public trading. Whether you’re a seasoned investor or a first-time participant, following this guide will help you navigate the IPO application process with confidence.