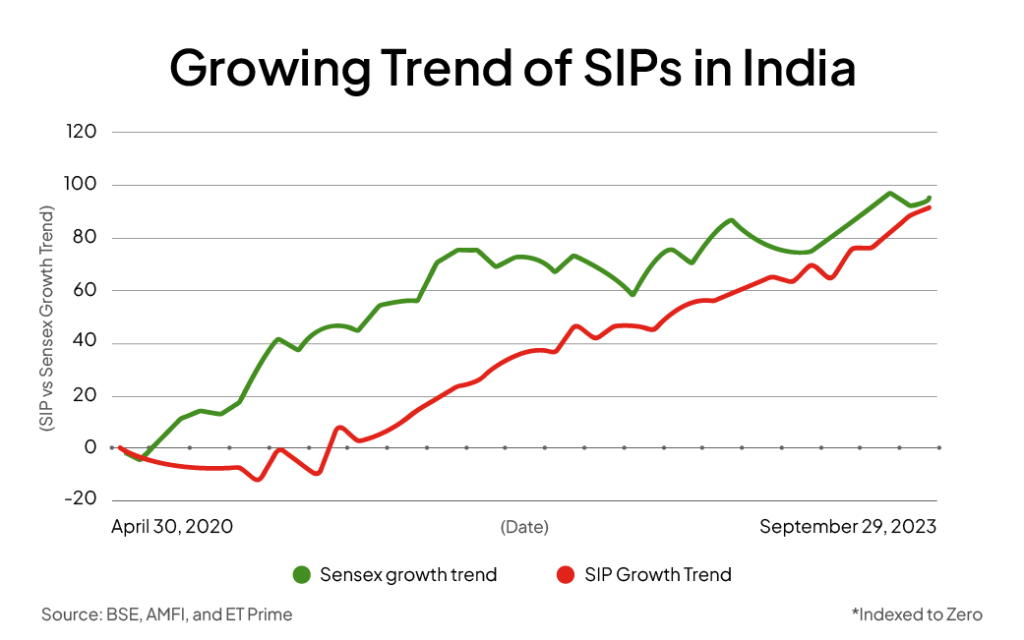

Systematic Investment Plan (SIP) has emerged as one of the most popular and efficient ways of investing in mutual funds in India. It allows investors to contribute a fixed amount regularly, ensuring disciplined savings and the potential for substantial wealth accumulation over time. This article will provide a detailed explanation of the benefits of SIP investment in India, along with real-life examples to illustrate how it works.

Table of Contents

What is SIP?

A Systematic Investment Plan (SIP) is a methodical approach to investing that allows individuals to contribute a fixed sum of money at regular intervals into a mutual fund scheme. This strategy is designed to promote disciplined investing, making it easier for individuals to build wealth over time without the need to invest large sums of money upfront.

How SIP Works

When you opt for a SIP, you commit to investing a specific amount of money (e.g., ₹500, ₹1,000, ₹5,000) on a regular basis. The intervals at which you invest can vary; the most common frequency is monthly, but SIPs can also be set up for weekly, quarterly, or even bi-annually. Each installment is used to purchase units of the chosen mutual fund based on the fund’s Net Asset Value (NAV) at the time of the purchase.

For example, if you decide to invest ₹5,000 every month in a mutual fund through a SIP, on the designated date each month, ₹5,000 will be deducted from your bank account and invested in the mutual fund. The number of units you receive each time will depend on the NAV of the fund on that particular date.

SIPs and Mutual Fund Types

SIPs are most commonly associated with equity mutual funds, which invest primarily in stocks or equities. These funds are known for their potential to generate high returns over the long term, though they come with higher risks due to market volatility. By investing regularly through a SIP, investors can mitigate some of the risks associated with market fluctuations.

In addition to equity funds, SIPs can also be used to invest in other types of mutual funds, such as:

- Debt Mutual Funds:

- These funds invest in fixed-income securities like government bonds, corporate bonds, and other debt instruments. They are generally less volatile than equity funds and are preferred by investors seeking stable returns with lower risk.

- SIPs in debt funds can be an effective way to build a conservative investment portfolio, especially for those with a lower risk appetite.

- Hybrid Mutual Funds:

- Hybrid funds, also known as balanced funds, invest in a mix of equity and debt instruments. They offer a balance between risk and return, making them suitable for investors looking for moderate risk exposure.

- By using a SIP to invest in hybrid funds, investors can benefit from the growth potential of equities while also enjoying the stability offered by debt instruments.

- ELSS (Equity-Linked Savings Scheme) Funds:

- ELSS funds are a type of equity mutual fund that provides tax benefits under Section 80C of the Income Tax Act. They have a lock-in period of three years, making them a popular choice for investors seeking both tax savings and long-term capital appreciation.

- Investing in ELSS through a SIP allows investors to spread their contributions throughout the year, reducing the impact of market timing and enabling consistent tax planning.

The Flexibility of SIPs

One of the key advantages of SIPs is their flexibility. Investors can choose the amount they wish to invest, the frequency of their investments, and the duration of their SIP. Additionally, most mutual fund companies allow investors to modify or stop their SIPs without any penalties. This flexibility makes SIPs accessible to a wide range of investors, from young professionals just starting their careers to seasoned investors looking to diversify their portfolios.

The Long-Term Perspective

SIPs are particularly effective when viewed as a long-term investment strategy. Over time, the regular investments made through SIPs benefit from the power of compounding, where the returns generated on the investment are reinvested to generate additional returns. The longer the investment horizon, the greater the potential for wealth accumulation.

Moreover, SIPs help investors navigate the inherent volatility of financial markets. By investing regularly, investors can average out the cost of their investments over time, a concept known as Rupee Cost Averaging. This means that they buy more units when prices are low and fewer units when prices are high, potentially lowering the average cost per unit over the investment period.

Key Benefits of SIP Investment in India

1. Disciplined and Regular Investing

One of the most significant advantages of SIP is that it encourages disciplined investing. By committing a fixed amount at regular intervals, investors are less likely to be swayed by market fluctuations or emotional biases.

Example:

Consider Mr. Sharma, who commits to investing ₹5,000 per month in an equity mutual fund through SIP. This disciplined approach ensures that Mr. Sharma regularly saves and invests, regardless of market conditions.

2. Rupee Cost Averaging

Rupee Cost Averaging (RCA) is a key benefit of SIPs. Since you invest a fixed amount regularly, you buy more units when prices are low and fewer units when prices are high. This averaging effect reduces the overall cost per unit over time.

Example:

- Month 1: Mr. Sharma invests ₹5,000 at a NAV of ₹50, purchasing 100 units.

- Month 2: The market dips, and the NAV falls to ₹40. Mr. Sharma’s ₹5,000 buys 125 units.

- Month 3: The market recovers, and the NAV rises to ₹60. Mr. Sharma’s ₹5,000 buys 83.33 units.

Over these three months, Mr. Sharma has invested ₹15,000 and accumulated 308.33 units. His average cost per unit is ₹48.65, which is lower than the average NAV of ₹50 for these three months.

3. Power of Compounding

The power of compounding is another significant advantage of SIPs. Compounding means earning returns on your returns, and the longer you stay invested, the more your money grows.

Example:

Suppose Mr. Sharma invests ₹5,000 per month for 20 years in a mutual fund that gives an average annual return of 12%. After 20 years, his total investment would be ₹12 lakh. However, due to compounding, his corpus would grow to approximately ₹50 lakh.

4. Flexibility

SIPs offer flexibility in terms of the amount you invest and the tenure. You can start a SIP with a small amount, typically as low as ₹500 per month, and you can increase or decrease your SIP amount as per your financial situation.

Example:

Ms. Roy starts her SIP with ₹1,000 per month. After a few years, when her income increases, she decides to increase her SIP amount to ₹5,000 per month, enhancing her potential returns without any hassle.

5. Convenience

SIPs are convenient and easy to set up. You can automate your investments, so the SIP amount is deducted from your bank account on a specified date every month. This automation ensures that you don’t miss any installments.

Example:

Mr. Verma sets up an SIP of ₹3,000 per month. He opts for auto-debit, ensuring that the amount is automatically deducted from his bank account on the 5th of every month. This convenience allows Mr. Verma to invest without worrying about manual transactions.

6. Mitigates Market Volatility

Investing in a lump sum exposes your entire investment to market conditions at that point in time. SIPs, on the other hand, spread your investments over time, reducing the risk associated with market volatility.

Example:

During a market downturn, Mr. Patel, who invested in SIPs, continues to accumulate units at lower prices. When the market eventually recovers, the value of his accumulated units increases, demonstrating how SIPs help mitigate the impact of market fluctuations.

7. Affordable for All Investors

SIPs are affordable and accessible to all types of investors, whether they are beginners or seasoned investors. The low minimum investment requirement allows anyone to start their investment journey.

Example:

A college student, Ms. Sharma, begins her investment journey with a SIP of ₹500 per month. Over time, as her income increases, she can increase her SIP amount. This affordable entry point encourages young investors to start early.

8. Diversification

SIPs allow you to diversify your investments across various mutual funds, reducing the risk associated with investing in a single asset class. By investing in different funds, you can spread your risk and improve your chances of earning higher returns.

Example:

Mr. Kumar decides to diversify his investments by starting SIPs in three different mutual funds: an equity fund, a debt fund, and a hybrid fund. This diversification helps him balance risk and return across different asset classes.

9. No Need to Time the Market

Timing the market is challenging and often leads to missed opportunities. SIPs eliminate the need to time the market, as you invest regularly regardless of market conditions.

Example:

Mr. Reddy invests through SIPs without worrying about whether the market is at a high or low point. Over time, his consistent investments help him accumulate wealth without the stress of trying to predict market movements.

10. Tax Benefits

Investing in Equity Linked Savings Schemes (ELSS) through SIPs offers tax benefits under Section 80C of the Income Tax Act. The amount invested in ELSS is eligible for a deduction of up to ₹1.5 lakh, reducing your taxable income.

Recommended Readings:

- Latest Income Tax Slab Rates in India 2024

- How to Calculate Income Tax in India: A Detailed Guide with Examples – 2024

Example:

Mrs. Kapoor invests ₹10,000 per month in an ELSS fund through SIPs. Over a year, she invests ₹1,20,000, which is eligible for a deduction under Section 80C. This investment reduces her taxable income, helping her save on taxes.

SIP vs. Lump Sum Investment: Which is Better?

SIP and lump sum investments both have their advantages, but SIPs are generally preferred for the following reasons:

- Regular Investments: SIPs encourage regular investing, ensuring that you save and invest consistently.

- Lower Risk: By spreading your investments over time, SIPs reduce the risk of entering the market at a wrong time.

- Affordability: SIPs allow you to start with a small amount and gradually increase your investment, making them accessible to everyone.

Example Comparison:

Mr. Singh has ₹1 lakh to invest. If he invests the entire amount in a lump sum and the market crashes soon after, his investment may suffer a significant loss. On the other hand, if he invests through SIPs, he can benefit from Rupee Cost Averaging and reduce the impact of market volatility.

Conclusion

SIP investments offer numerous benefits, making them an ideal choice for individuals looking to build wealth over time. Whether you are a seasoned investor or a beginner, SIPs provide a disciplined, flexible, and convenient way to invest in mutual funds. With the power of compounding, rupee cost averaging, and the ability to mitigate market risks, SIPs can help you achieve your long-term financial goals.

By understanding the advantages of SIPs and how they work, you can make informed decisions about your investments and build a strong financial future.

Disclaimer: Mutual Fund investments are subject to market risks, read all scheme related documents carefully.