Mutual Funds in India: A Comprehensive Guide

Mutual funds are increasingly becoming popular investment vehicles in India, offering a convenient way for investors to access diversified portfolios managed by professional fund managers. Whether you’re new to investing or seeking advanced strategies, understanding mutual funds can help you make informed decisions to achieve your financial goals.

If you’re new to investing, mutual funds provide an excellent starting point due to their simplicity and accessibility. Here’s what you need to know:

What are Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Each investor owns shares in the mutual fund, representing a portion of the fund’s holdings.

Types of Mutual Funds

There are various types of mutual funds in India, including:

- Equity Funds: Invest primarily in stocks, offering growth potential with higher risk.

- Debt Funds: Invest in fixed-income securities like bonds and government securities, providing stable returns with lower risk.

- Hybrid Funds: Invest in a mix of stocks and bonds, offering a balance between growth and stability.

- Index Funds: Mirror the performance of a specific stock market index, such as the Nifty 50 or Sensex.

Benefits of Mutual Funds

Key benefits of investing in mutual funds include:

- Diversification: Spread investment across multiple securities, reducing risk.

- Professional Management: Managed by experienced fund managers who make investment decisions on behalf of investors.

- Liquidity: Easily buy or sell mutual fund units on stock exchanges.

- Accessibility: Suitable for investors with varying risk appetites and investment goals.

For experienced investors seeking advanced strategies, mutual funds offer a range of options to optimize returns and manage risk:

Asset Allocation

Asset allocation involves dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash equivalents, based on your risk tolerance and investment objectives. Mutual funds with diversified holdings can help achieve optimal asset allocation.

Systematic Investment Plan (SIP)

A SIP allows investors to invest a fixed amount regularly (e.g., monthly or quarterly) in a mutual fund scheme. This disciplined approach to investing can help average out market fluctuations and harness the power of compounding over time.

Tax Planning

Investing in tax-saving mutual funds, such as Equity Linked Savings Schemes (ELSS), can help investors avail tax benefits under Section 80C of the Income Tax Act. ELSS funds offer the dual benefit of tax savings and potential wealth creation through equity investments.

Risk Management

Investors can manage risk through strategies such as diversification, asset allocation, and investing in funds with low expense ratios and consistent performance records. Regular review of portfolio holdings and market conditions is essential for effective risk management.

Shani Finserve Private Limited: Optimizing Your Portfolio

Shani Finserve Private Limited offers a comprehensive suite of portfolio management services designed to help investors achieve better returns over the long term. Our expert team of financial advisors utilizes a data-driven approach and in-depth market analysis to craft customized investment strategies tailored to your unique financial goals and risk profile.

With a focus on transparency, integrity, and customer satisfaction, Shani Finserve Private Limited aims to empower investors with the knowledge and tools they need to build and manage successful investment portfolios. Whether you’re a beginner or seasoned investor, our dedicated team is committed to providing personalized guidance and support every step of the way.

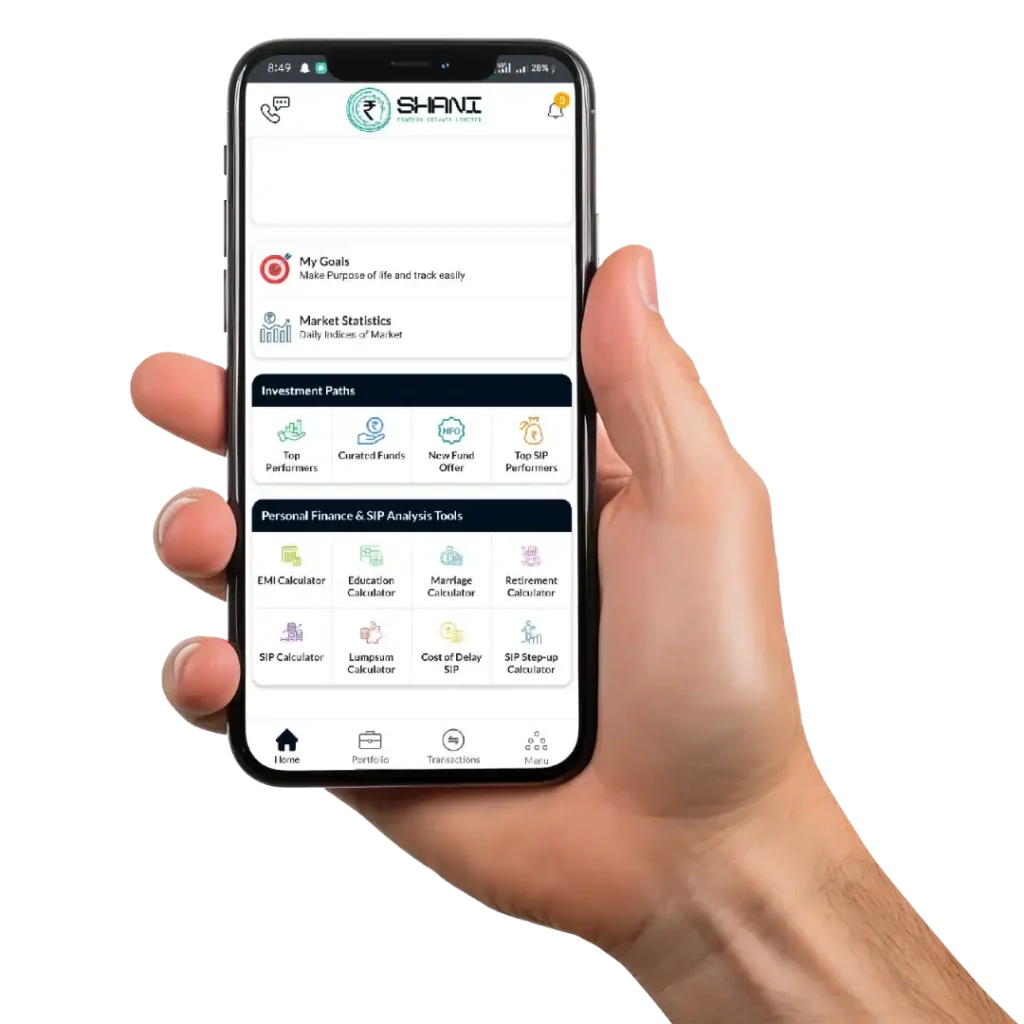

Download Shani Finserve App

Invest with confidence and unlock your financial potential by downloading Shani Finserve App designed for Android and iOS.

Shani Finserve is Investment MF Tracking Application for the clients of Shani Finserve Private Limited, India

Shani Finserve app allows clients to log in and easily monitor their investment portfolio, including various financial instruments such as mutual funds. It provides an overview of your investments, along with detailed insights into each scheme.

Additionally, you can download comprehensive portfolio reports.

The app also offers a suite of financial calculators to help you understand the potential growth of your investments over time, including:

Retirement Calculator: To plan for your retirement savings.

Education Fund Calculator: To estimate the cost of funding education for children or yourself.

Marriage Calculator: To plan for marriage-related expenses.

SIP Calculator: To calculate the future value of Systematic Investment Plans (SIPs).

SIP Step-Up Calculator: To model the impact of increasing your SIP contributions over time.

EMI Calculator: To calculate equated monthly installments for loans.

Lumpsum Calculator: To project returns on lump-sum investments.

These tools help you plan and track your financial goals with the power of compounding and long-term investment growth.